Taking out the right holiday home insurance could be the most important thing you ever do after signing your pitch licence agreement.

It can sometimes be overwhelming, with many providers offering different advice and options. We’ve looked at the most common questions asked by new or prospective insurance policyholders, and answered them honestly and simply for you.

The market is saturated with quality holiday home and leisure home insurance providers, and this article will shed some light on the key elements and policies to look out for.

- What is holiday home insurance?

- Why do I need holiday home insurance?

- What does holiday home insurance cover?

- How do I get the best insurance for me?

- How do I know which cover I need?

- Are there any optional extras?

- Is there anything my insurance won’t cover?

- Is holiday home insurance a legal requirement?

- Is there any fine print to look out for?

- How much will it cost?

- How can I save money on my insurance?

- Can I take out insurance if I live in my holiday home?

- Independent insurance agent VS. insurance broker

What is static caravan/ holiday home insurance?

A holiday home is more like a semi-permanent residence than a vehicle you move around in (like a tourer caravan.) For this reason, taking out an insurance policy on your holiday home is more like insuring your own house than your car.

Owners take out holiday home insurance to cover things like fire damage, weather damage, and even vandalism. Like a house insurance policy, it covers not just damage and destruction, but also your personal contents inside. This, however, means the insurance policy doesn’t tend to cover general wear and tear.

Why do I need holiday home insurance?

Insuring your car is compulsory: but insuring your holiday home is not. Industry experts strongly advise to take out cover, and it’s also a requirement for most holiday parks in order to keep your holiday home on their site. Holiday parks will expect you to have basic cover, like public liability insurance and accidental damage. But there are plenty more personal reasons to insure your home-from-home investment than keeping a holiday park happy. Read on to discover more.

What does holiday home insurance cover?

Any basic or standard holiday home insurance covers the following:

- Accidental or malicious damage: if your holiday home is damaged due to an accident or criminal activity

- Third-party liability: if someone is injured on or in your holiday home, or damage is somehow caused to another person’s property

- Theft: if your holiday home is subject to theft at a campsite

- Extreme weather: if damage occurs in adverse conditions such as a storm

How do I get the best insurance for me?

It’s always best to approach caravan insurance enquiries with sound knowledge of what protection you want. In turn, this will affect the price. The questions you should ask yourself beforehand are:

- How much is my holiday home worth?

- Where do I keep it (normally, this is a holiday park but some owners store them on private land or special storage facilities over winter.)

- Does my holiday home have any security features?

- What contents are inside and what is their overall value?

- What is my claims history?

- How much cover do I want and will I need any add-ons?

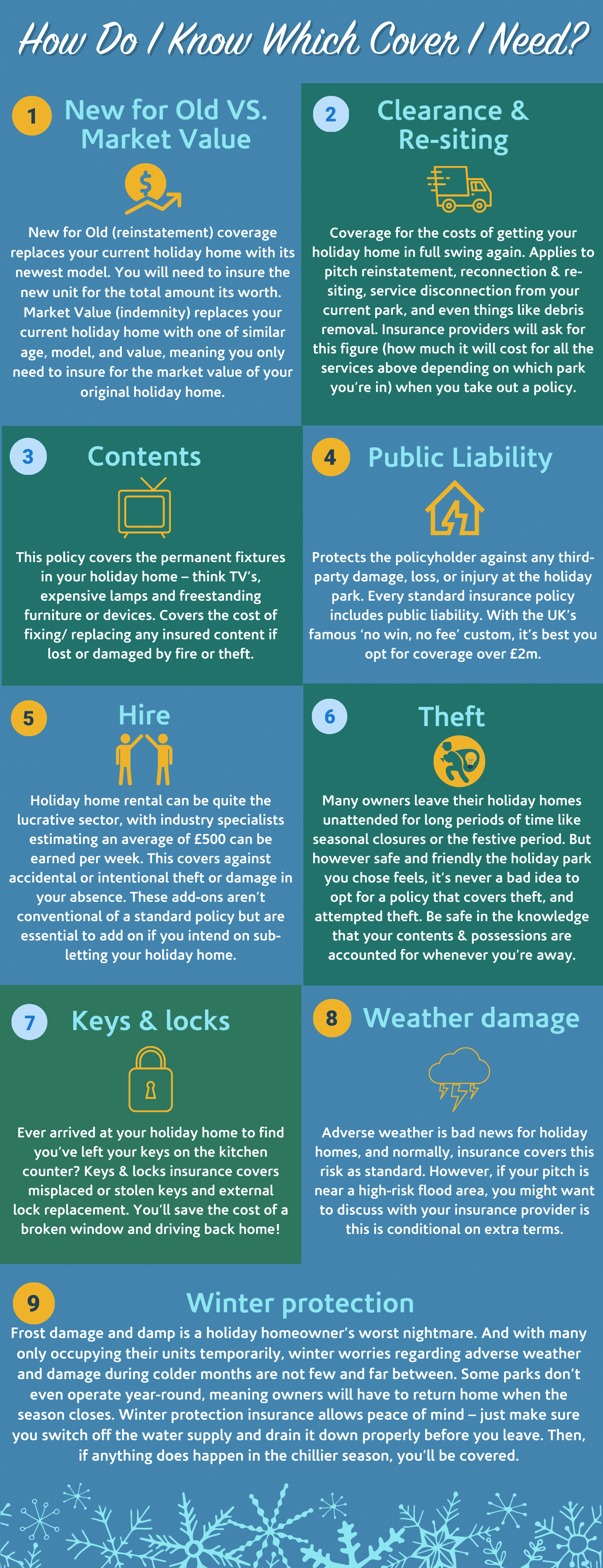

How do I know which cover I need?

A plethora of holiday home insurance covers exist, which can be a rather daunting thought. But don’t worry, below we’ve listed everything you need to know about each option:

Are there any optional extras?

We mentioned above additional extras like hire and contents cover if you’re planning on allowing other people to stay in your holiday home. You can also select cover for use by friends and family, meaning your nearest and dearest can stay in your holiday home without having to seek separate insurance for each trip.

It’s also worth looking at the excess cover, which in the event of a claim covers the cost of your excess. This can seem rather pricey to begin with but could save pennies in the long run.

If you are thinking of moving your holiday home abroad, the European Static Caravan Insurance Policy covers contents, accidental damage, garden ornaments and public liability insurance. Brexit should not affect these as most European countries remain in the EU.

Is there anything my insurance won’t cover?

While holiday home insurance covers many aspects, there are a few exclusions to standard policy. The most notable exceptions are general wear and tear, theft if your holiday home is left unlocked or with the windows open, and damage due to vermin or insect infestation. You also won’t be covered if you’re using your holiday home as your main residence, or if you’re running any sort of business from there.

Is holiday home insurance a legal requirement?

Above, we discussed how that holiday home insurance is not a legal requirement – like car insurance is. Although it’s not mandatory by law, it’s against most holiday park policies. Holiday parks have the right of refusal to assign you a pitch if you do not have valid holiday home insurance, and if yours does expire after the initial period, you could be in breach of your pitch licence agreement.

Oftentimes, it’s a reasonable judgement to cover yourself in case of an emergency – whether to you, your own property, or someone else’s. Not only are you financially and legally sound in case of an incident, but you will also be able to holiday (and rest at home out of season!) with peace of mind.

Rare, but true, cases exist which consist of owners leaving their holiday home uninsured on a holiday park. This unit was flipped over in extremely high winds, causing damage to a nearby holiday home which was insured. The owners of the second holiday homemade a successful claim against the original owners. Although they had no insurance, a hefty claim could be made against them.

Is there any fine print to look out for?

You wouldn’t sign a contract without checking the fine print, would you? The same applies to holiday home insurance policies. Here are some things to be aware of before you start comparing quotes – which will hopefully save you some time and confusion.

- The policy providers expect the motorhome resides on a licenced holiday park or camping site that has acceptable security and surveillance, within an area that is not prone to flooding

- Your holiday home ought to be securely anchored on the pitch

- Industry-approved items (like GPS) is not mandatory but it is preferred and could help keep your insurance cost low

- Standard insurance does not cover holiday homes which are considered permanent residence

How much will it cost?

Each insurance policy is different and will depend on many factors. Your holiday home’s value and its contents, how secure it is, and where it’s kept are such factors. Any optional add-ons and the policy excess you choose will also impact the overall price – for example, increasing the excess may bump down your premiums.)

Are there any money-saving tips on caravan insurance?

As with any insurance policy, shopping around is the best way to make sure you cover all bases and hunt out all deals. Below are a few tips on how to keep the price lower and your holiday home even more secure:

- Add extra security features: many insurance providers offer a discount if a Sold Secure Standard Alarm is installed. Improving the locks on windows and doors will also bring down costs. Installing a GPS tracking device (Thatcham graded) can also bring your premiums down.

- Join a caravan club: it’s definitely worth looking around at which clubs offer discounts on insurance.

- Choose a CasSSOA registered site: this stands for caravan storage site owners’ association site. Sites are graded bronze, silver or gold, the latter being the most secure and cost-saving

Can I take out holiday home insurance if I live in my caravan?

In short, you can – but you might find there are fewer providers to choose from. Living in a holiday home is perfectly legal, as long as you declare this during an insurance application. The unit must also be located at a legitimate location such as a holiday park. Permanent residence requires a different type of insurance, but it is possible

What’s the difference between an independent insurance agent and an insurance broker?

Agents work with a company, and a broker has partnerships with many companies. This gives their prospective customers a greater choice of policies to chose from. It’s important to point out that independent insurance agents work with the insurance providers’ best interests. Thus, not necessarily the individual policyholders. A broker, however, has its customers best interests at heart.